January 2026 Update:

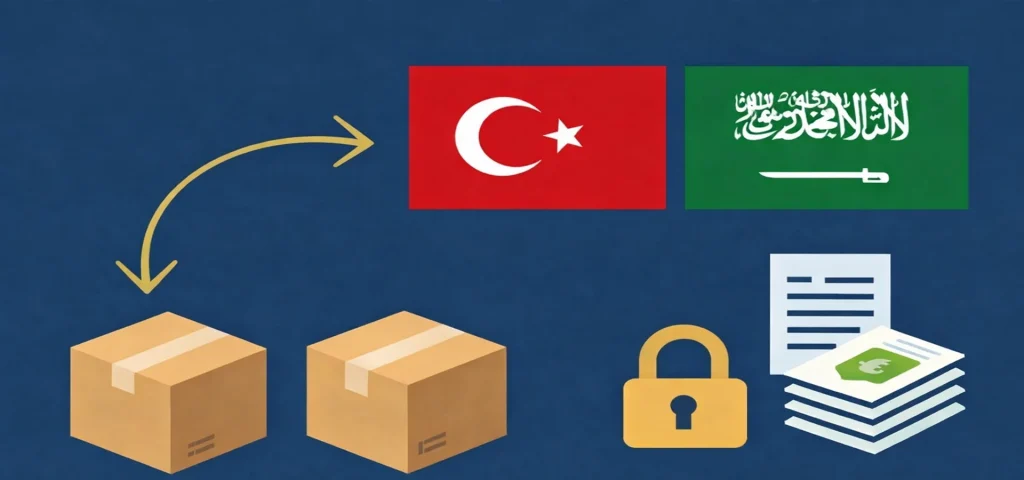

With the growing volume of trade between Turkey and the Kingdom, the Zakat, Tax and Customs Authority (ZATCA) has enforced strict standards to ensure the safety of imports. Any error in documentation or specifications may cost you hefty fines or require re-exporting the shipment.

In this legal guide from “Turk Mersal,” we provide you with the full list of conditions and required documents to smoothly clear your goods without surprises.

First: Legal Requirements for Importers (Before Purchase)

Commercial importation in Saudi Arabia is not just about “buying and shipping.” Before paying a single dollar to your Turkish supplier, make sure your business is legally ready:

- Active Commercial Registration:

You must have a valid commercial registration, with “import activity” listed and matching the type of goods being imported. - Tax Registration:

A registered VAT number with the authority is required. - FASAH Platform:

This is the national single window. You must authorize a customs broker (like Turk Mersal) electronically via the platform so they can complete your shipment’s procedures on your behalf.

Second: SABER System and Product Conformity Standards

Saudi Customs will not allow entry of any consumer product not registered in SABER. This step must be completed before shipping, not upon arrival.

Conformity Steps in 2026:

- Product Certificate of Conformity (PCoC):

A certificate proving the product (clothing, appliances, furniture) complies with Saudi standards (SASO). Valid for one full year. - Shipment Certificate of Conformity (SCoC):

Issued for each specific shipment. This is the document required by customs to release the goods. - “Made in Turkey” Marking:

A non-negotiable condition. The phrase Made in Turkey must be engraved or printed in a non-removable manner on each item — not just on the outer carton.

⚠️ Legal Warning:

Violating the “Country of Origin” requirement is considered commercial fraud and leads to immediate confiscation of goods.

Third: The Golden Checklist of Documents

To avoid clearance delays, ask your Turkish supplier to prepare these documents accurately, and ensure all data matches exactly across all papers:

| Document | Legal Description | Important Notes |

|---|---|---|

| Commercial Invoice | Details goods description, quantity, and total value | Must be certified by the Turkish Chamber of Commerce |

| Certificate of Origin | Proves origin of goods (Turkey) | Required to benefit from any customs exemptions (if applicable) |

| Bill of Lading | Contract of transport between you and the shipping company | Issued by “Turk Mersal” showing route and weight |

| Packing List | Itemized contents of each package (weight, dimensions) | Must match the invoice and actual goods 100% |

| SABER Certificate (SCoC) | Electronic certificate | Automatically linked with the customs declaration via FASAH |

Fourth: Customs Duties and Taxes (2026 Update)

As an importer, be ready to pay the following dues via the “SADAD” system or the e-wallet in the FASAH platform:

- Customs Duties:

Usually range from 5% to 15% depending on the product’s HS Code.- Exemptions:

Some goods may be partially or fully exempted if accompanied by a EUR.1 Certificate (in case of applicable trade agreements) or industrial products exempted by ministerial decision.

- Exemptions:

- Value Added Tax (VAT):

15%, calculated as:

(Goods Value + Shipping Cost + Customs Duties) × 15% - Declaration and Handling Fees:

Administrative fees paid to the port and customs broker.

Fifth: Restricted and Prohibited Goods

Not everything sold in Turkey is allowed into Saudi Arabia. Check the following lists to avoid legal issues:

- Restricted Goods (Require Prior Approval):

- Food & Medicine ⬅️ Require approval/classification by SFDA.

- Chemical Products ⬅️ Require chemical clearance.

- Telecommunication Devices ⬅️ Require approval from CITC.

- Absolutely Prohibited Goods:

- Counterfeit products (Copy Brands)

- Materials contrary to Islamic law or public morals

- Certain types of used equipment

Sixth: Turk Mersal’s Role in Your Legal Protection

We understand that an importer’s worst nightmare isn’t shipping cost — it’s goods being held at port. With continuous regulatory updates from ZATCA, Turk Mersal evolves from a logistics carrier to your strategic customs protection partner.

Here’s how we protect your trade step by step:

- Pre-Shipment Audit:

We don’t wait for your goods to reach Saudi ports to detect issues. Our legal team in Istanbul thoroughly reviews all drafts (invoices, certificates, bills of lading) and ensures literal compliance with FASAH requirements before the truck even moves a meter. - Full SABER File Management:

We know SABER can be technically challenging. We register your products on your behalf and coordinate with accredited conformity bodies to quickly issue PCoC and SCoC certificates — ensuring your goods are digitally cleared before arrival. - End-to-End DDP Shipping Solution:

For complete peace of mind, we offer door-to-door shipping, inclusive of all fees and duties. In this DDP model, we assume the risks, handle the customs brokers, pay the dues, and deliver your goods “fully cleared” to your warehouse with a single final invoice. - Crisis Management:

In case of customs emergencies (e.g., lab sample request or value inquiry), our brokers are present at the ports (Jeddah Islamic Port, Dammam Port, Al-Haditha Border) for immediate intervention — helping you avoid costly storage charges.

Frequently Asked Questions (FAQ) – Full Version (7 Questions)

We’ve gathered the most complex questions facing importers in 2026, with clear legal answers:

Q1: Can I import commercial goods under my personal name without a commercial registration?

A: Saudi customs is very strict. Commercial quantities (clearly beyond personal use) require an active commercial registration. If you attempt to import such goods personally, they’ll likely be held, and you’ll be required to appoint a customs broker and convert the declaration to commercial — causing delays and fines — or possibly be forced to re-export.

Advice: If you’re a new trader without a license, contact us to discuss legal individual shipping solutions within permitted limits.

Q2: What’s the penalty for missing the “Made in Turkey” mark on each item?

A: This is one of the top reasons shipments are rejected. The regulation clearly states that the country of origin must be non-removable (engraved or stitched). If violated, customs may force you to choose between two difficult options:

- Re-export the entire shipment (at your cost)

- In rare cases, allow on-site correction for a high fine and storage fees.

At Turk Mersal, we check this point strictly before shipping.

Q3: How are customs duties assessed if the invoice value isn’t clear?

A: If customs suspects the declared invoice value is “below market” (to evade tax), they’re legally allowed to disregard it and apply their internal reference price lists — which can significantly increase your cost.

Tip: Always submit genuine, certified invoices to avoid “revaluation.”

Q4: What’s the difference between PCoC and SCoC in SABER?

A:

- PCoC (Product Certificate of Conformity): Issued once per product model; valid for one year.

- SCoC (Shipment Certificate of Conformity): Issued for each individual shipment. You can’t ship without it. It requires a valid PCoC.

Q5: Are goods imported from Turkey customs-exempt?

A: Not automatically. Though agreements exist, exemption requires:

- The product must be 100% Turkish in origin

- A valid EUR.1 Certificate of Origin or equivalent must be provided.

Without this certificate, standard duties (5–15%) will apply — even for Turkish goods.

Q6: Can I import cosmetics and personal care products in commercial quantities?

A: These fall under SFDA oversight. To import commercially, products must first be listed and registered in SFDA’s eCosma system.

Shipping without prior registration will result in the goods being held at the port until clearance is obtained — a process that may take months.

Q7: How do I pay customs duties?

A: The process is fully electronic. Once the customs declaration is issued, you’ll receive an SMS on your registered mobile (via FASAH) with a SADAD payment number. You can pay instantly via your bank app.

Note: Our DDP service at Turk Mersal handles this step for you — we pay on your behalf.

Need to Review Your Shipment Documents Before Launch?

Don’t take risks. Send us scanned copies of your documents now, and our customs clearance team will review them for free to ensure full compliance with 2026 requirements.